Financial Education

University of Wisconsin-Madison, Division of Extension offers a number of resources to help families and individuals stretch their dollars and meet their financial goals.

This series of online modules can help you learn new money management skills and build on your financial strengths. Contact our UW Madison Extension Douglas County Educator to learn how you can receive a certificate of completion to meet local financial education requirements.

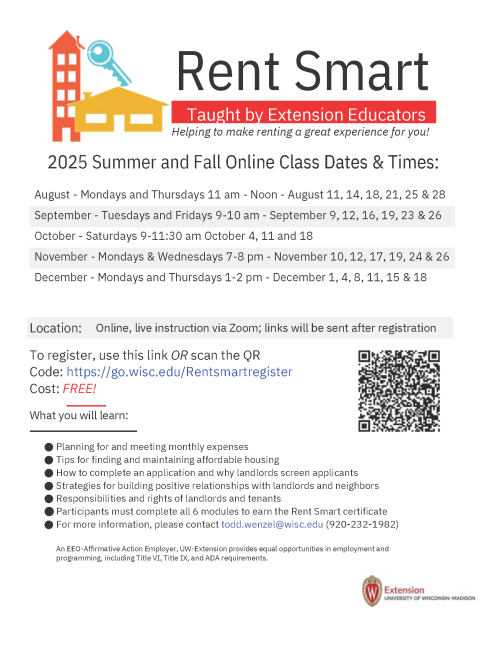

Renting affordable housing is a big step. This program helps individuals build knowledge and skills for a successful rental experience. Virtual classes are now available statewide. CLICK HERE to register for a virtual class. The dates for classes and class times can be found on the flyer:

Contact our UW-Madison Extension Douglas County educator for information on how to schedule a workshop for your organization.

Covid related facts sheets for renters and landlords

- Eviction alternatives–fact sheet for landlords (PDF, 2 pgs,431 KB)

- Renters–what to do when eviction moratorium ends. (PDF, 1 pg., 212 KB)

Building and Maintaining Credit Advice on how to build or maintain credit and how to regularly check your free credit report

Other Resources

Check Your Credit Report Lots of people can read your credit report: landlords, employers, insurance agencies, banks and more. You should know what they see. Learn why credit reports matter and how to check yours.

Pay Down Debt with Power Pay Making “Power Payments” is a widely recommended way to pay down debt faster so you can start saving. This website from Utah State University Extension offers tools that make it easy to implement this strategy. Also features other useful resources like a Spending Plan tool that creates your budget online instead of with a pencil and paper.

Spend Smart Eat Smart This fun, interactive resource from Iowa State University Extension offers a number of useful tools for cutting back on food costs. Meal planning, smart shopping, low-cost recipes and more.

To schedule an appointment, arrange a workshop/training or ask a question contact:

Tracy Henegar

UW-Madison Extension Douglas County

Human Development & Relationships Educator

1313 Belknap St Room 107

Superior, WI 54880

715-395-1426

tracy.henegar@wisc.edu

711 for Wisconsin Relay (TDD)